When it comes to retirement savings, employer-sponsored 401(k) plans play a pivotal role in helping employees build their financial futures. Walmart, one of the largest employers in the world, offers its own 401(k) plan for employees, but how does it compare with other employers’ 401(k) offerings? This article provides a comprehensive comparison of Walmart’s 401(k) plan and other common employer retirement plans, highlighting key differences, benefits, and considerations for employees who want to make the most of their retirement savings options.

Understanding Walmart’s 401(k) Plan

1. Overview of Walmart’s 401(k) Plan

Walmart’s 401(k) plan is available to eligible employees, both full-time and part-time. The plan allows employees to save for retirement by contributing a portion of their income to an account before taxes are deducted. Employees can choose how to invest their contributions from a selection of mutual funds, stocks, and bonds, depending on their retirement goals and risk tolerance.

Walmart’s 401(k) plan is designed to help employees save more effectively for retirement, offering a variety of investment options and a company match.

2. Eligibility and Enrollment in Walmart 401k

To participate in Walmart’s 401(k) plan, employees must meet certain eligibility requirements. Generally, employees who have worked for Walmart for at least one year are eligible to enroll in the plan. After meeting this requirement, employees can begin contributing to their 401(k) via payroll deductions, with contributions made automatically.

The enrollment process is straightforward, and Walmart offers an online platform for employees to manage their 401(k) accounts, view investment options, and track the growth of their savings.

3. Employer Matching Contributions

A significant benefit of Walmart’s 401(k) plan is the employer match. Walmart matches 100% of employee contributions up to the first 6% of an employee’s salary. This means that if an employee contributes 6% of their salary to their 401(k), Walmart will contribute an equal amount, effectively doubling the employee’s contribution.

The employer match is an excellent incentive for employees to maximize their contributions and boost their retirement savings. However, it is important to note that Walmart’s match is subject to a vesting schedule.

4. Vesting Schedule

Vesting refers to the amount of time an employee must work at Walmart before they fully own the employer’s matching contributions. Walmart’s 401(k) vesting schedule requires employees to stay with the company for at least three years to become fully vested in the employer contributions. If an employee leaves the company before reaching the three-year mark, they forfeit some or all of the employer’s contributions.

5. Investment Options in Walmart 401k

Walmart’s 401(k) plan offers a wide range of investment options, including target-date funds, index funds, and more actively managed mutual funds. These options allow employees to choose how to allocate their savings based on their risk tolerance and time horizon for retirement.

Target-date funds, in particular, are popular for their hands-off approach, as the asset allocation automatically adjusts over time as the employee approaches retirement age. This makes it easier for employees who may not have extensive investment knowledge to choose an appropriate investment strategy.

6. Fees and Expenses

Walmart’s 401(k) plan is known for its relatively low fees, which can be a significant advantage in terms of in Walmart 401k maximizing long-term savings. The main fees associated with the plan are administrative fees and the expense ratios of the mutual funds chosen by employees. Walmart strives to keep these fees competitive, but it’s still essential for employees to regularly monitor their accounts to ensure they are not paying unnecessary fees.

Comparing Walmart’s 401(k) Plan to Other Employer Plans

While Walmart’s 401(k) plan offers several benefits, it’s important to see how it compares to the 401(k) plans offered by other employers. Let’s look at some key factors to consider when comparing Walmart’s plan to others in the industry.

1. Contribution Limits

One of the primary aspects of any 401(k) plan is the contribution limit. For 2025, the IRS has set the contribution limit for 401(k) plans at $22,500 for employees under the age of 50. For employees aged 50 or older, the catch-up contribution allows them to contribute an additional $7,500, bringing the total contribution limit to $30,000.

Walmart allows employees to contribute up to the maximum IRS limit, which means you can take full advantage of the contribution limit. However, it’s important to consider other factors such as employer matches and fees when evaluating the plan’s overall value.

2. Employer Matching Contributions

Employer contributions are a key element of 401(k) plans, and Walmart’s 100% match on the first 6% of employee contributions in in Walmart 401k is competitive within the retail industry. However, other employers—especially in sectors like tech, finance, and healthcare—may offer more generous matches. For instance, companies like Microsoft or Google often offer matches up to 100% on the first 6-7% of salary, but they might also include additional incentives, such as profit-sharing or discretionary contributions.

For employees seeking to maximize employer contributions, companies with more robust match offerings may be more appealing, especially if they are offering higher-than-average contribution rates.

3. Vesting Schedules

The vesting schedule can significantly affect how employees benefit from their employer’s contributions. Walmart has a three-year vesting schedule, which means that employees need to work at least three years before they fully own the employer-contributed funds.

In comparison, many other employers in different industries offer more immediate vesting or shorter vesting periods. Some companies in the tech or financial sectors offer immediate vesting, allowing employees to fully own employer contributions as soon as they are made. Others may have a shorter vesting period of one to two years.

4. Investment Options and Flexibility

Walmart offers a broad selection of mutual funds, including target-date funds and index funds. However, other companies may provide even more investment options, especially in industries that place a higher emphasis on financial services and investment management.

For example, large financial firms like Vanguard or Fidelity offer extensive investment options within their 401(k) plans, including access to proprietary funds, individual stocks, and bonds. This flexibility can be beneficial for employees who have specific preferences for how they want their money managed or those who wish to invest more actively.

Additionally, companies in the tech sector may offer more advanced tools and resources to help employees manage their retirement accounts, including access to professional financial advisors or retirement planning tools.

5. Fees and Expenses

The fees associated with 401(k) plans can vary significantly depending on the employer. Walmart is known for offering relatively low fees, which can help employees save more in the long run. However, other companies, especially those in the finance sector, may offer even lower fees or more fee-transparent options.

Employees should pay close attention to both administrative fees and the expense ratios of the mutual funds they choose. High fees can erode investment returns over time, so choosing a plan with competitive fees is crucial for long-term growth.

6. Additional Retirement Savings Options

Some employers offer additional retirement savings options beyond the standard 401(k). For example, some companies provide Roth 401(k) options, which allow employees to contribute after-tax dollars and make tax-free withdrawals during retirement. While Walmart’s 401(k) plan does not currently offer a Roth option, other employers, such as tech and financial companies, do.

Additionally, certain employers in the non-profit or educational sectors may offer 403(b) plans, which are similar to 401(k) plans but designed for employees of non-profit organizations. These plans may have slightly different contribution limits or investment options, and employees in these sectors may benefit from tax-exempt contributions.

7. Other Retirement Benefits

Some companies provide more than just a 401(k) plan. For example, employers like Google and Microsoft often offer profit-sharing, stock options, and other financial benefits that can supplement their retirement plans. These additional perks can make a significant difference in employees’ financial security after retirement.

Other Employer Retirement Plan Options

In addition to traditional 401(k) plans, there are other types of employer-sponsored retirement savings plans. Here’s a brief look at some of them:

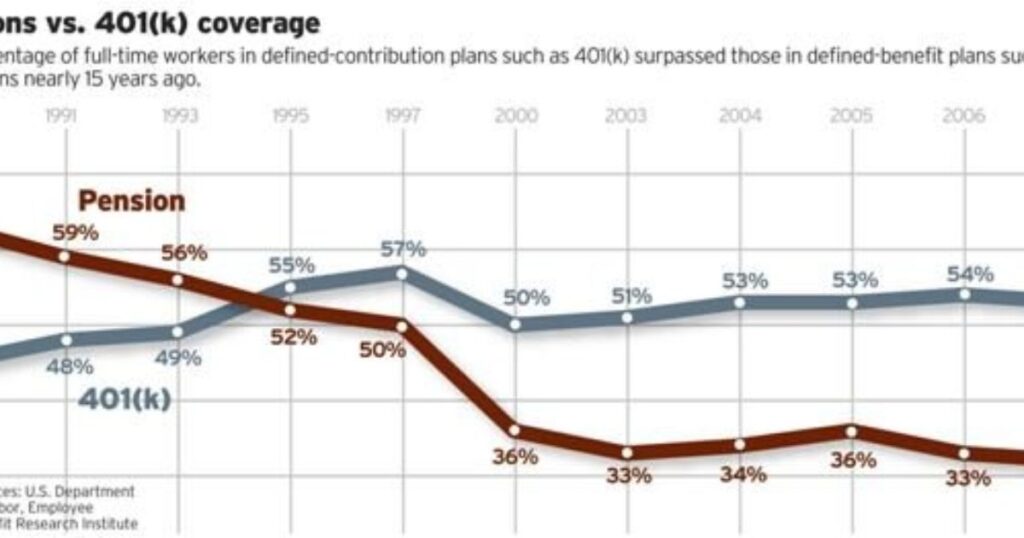

1. Pension Plans

Although less common today, pension plans are still offered by certain employers. These plans guarantee a fixed income during retirement based on an employee’s salary and years of service. Unlike 401(k) plans, where employees are responsible for their investment choices, pension plans are managed by the employer, and employees don’t have to worry about market fluctuations.

2. Roth 401(k)

A Roth 401(k) allows employees to contribute after-tax dollars to their 401(k), which means that qualified withdrawals during retirement are tax-free. Some companies, especially in the financial and tech industries, offer a Roth 401(k) option as part of their retirement plan offerings.

3. SEP IRAs

Self-employed individuals or small business owners may be eligible for a Simplified Employee Pension (SEP) IRA. These plans allow employers to contribute to employees’ retirement savings, but they are different from traditional 401(k) plans in terms of contribution limits and eligibility criteria.

Suggestion’s

- Compare Employer Matching Contributions: Evaluate the employer match in Walmart’s 401(k) plan (100% match on the first 6% of employee contributions) against other companies, especially those offering higher matches or additional incentives such as profit-sharing.

- Understand Vesting Schedules: Review Walmart’s 3-year vesting schedule for employer contributions and compare it with other companies that might offer immediate vesting or shorter vesting periods, which can affect your long-term retirement savings.

- Assess Investment Options: Compare the variety and flexibility of investment choices in Walmart’s 401(k) plan (including target-date funds and index funds) with those offered by other employers. Some companies might offer broader or more specialized investment opportunities.

- Examine Fees and Expenses: Pay attention to the fees associated with Walmart’s 401(k) plan, such as administrative costs and fund expense ratios, and compare them to other employers’ plans. Lower fees can lead to greater long-term savings.

- Consider Additional Retirement Plans: Look beyond the 401(k) and check if other employers offer additional retirement benefits, such as Roth 401(k)s, pensions, or stock options, which could provide more comprehensive retirement savings opportunities.

Conclusion

Walmart’s 401(k) plan offers several attractive features, including a strong employer match and a range of investment options. However, it’s important for employees to compare Walmart’s plan to the 401(k) offerings from other employers to understand how it stacks up in terms of contribution limits, employer matching, vesting schedules, fees, and investment options.

Ultimately, the best 401(k) plan for an individual depends on their specific needs, retirement goals, and the benefits offered by their employer. Whether you are just starting to save for retirement or you are looking to maximize your savings, understanding the features of your employer’s 401(k) plan is a crucial first step.

FAQ’s

What is Walmart’s 401(k) employer match?

Walmart offers a 100% match on the first 6% of employee contributions.

How long does it take to become vested in Walmart’s 401(k)?

Employees become fully vested in Walmart’s 401(k) contributions after 3 years of service.

What investment options are available in Walmart’s 401(k) plan?

Walmart offers a range of mutual funds, including target-date funds and index funds.

How do Walmart’s 401(k) fees compare to other employers?

Walmart’s 401(k) plan generally has competitive, low fees compared to many other employer plans.

Does Walmart offer a Roth 401(k) option?

No, Walmart does not currently offer a Roth 401(k) option for its employees.