Walmart is one of the largest employers in the world, providing job opportunities for millions of individuals across the globe. In addition to offering competitive wages and benefits, the company also provides a comprehensive 401(k) retirement plan for its employees. This retirement savings option is designed to help Walmart associates build a secure financial future. However, understanding the details of Walmart’s 401(k) plan can be a bit complex. In this article, we will break down the key features of the Walmart 401(k) plan, including its benefits, matching contributions, eligibility, and how it compares to other retirement plans in the industry.

What is Walmart’s 401(k) Plan?

Walmart’s 401(k) plan is a retirement savings account offered to eligible employees to help them save for the future. This plan allows employees to set aside a portion of their paycheck into a tax-advantaged account. The funds can be invested in various options, such as mutual funds, stocks, bonds, and more, to grow over time. Walmart’s 401(k) plan is a key benefit that helps employees save for retirement, and the company offers additional features that enhance its value.

How Walmart’s 401(k) Plan Works

Walmart’s 401(k) plan operates under the typical guidelines of employer-sponsored retirement savings accounts. Employees can choose to contribute a portion of their income into the 401(k) account. Contributions are typically made on a pre-tax basis, meaning they are deducted from the employee’s paycheck before income taxes are applied. This can lower taxable income for the year and help individuals save more for retirement.

Contribution Limits

For 2025, employees under the age of 50 can contribute up to $22,500 to their 401(k) plan each year. Employees aged 50 or older can take advantage of the “catch-up contribution” rule, which allows them to contribute an additional $7,500, bringing their total contribution limit to $30,000.

Walmart 401(k) Plan: Employer Matching Contributions

One of the key highlights of Walmart’s 401(k) plan is its matching contribution feature. Walmart offers a competitive match for employee contributions, which can significantly boost an individual’s retirement savings.

How Walmart’s Matching Contributions Work

Walmart’s matching contributions are structured in a tiered system, meaning that the company matches employee contributions up to a certain percentage of their salary. Here’s how it works:

- First 6% of Employee Contributions: Walmart matches 100% of the first 6% of the employee’s contribution. For example, if you contribute 6% of your salary to your 401(k), Walmart will match it dollar-for-dollar.

- Additional Contributions: For any contributions made beyond the 6%, Walmart offers a 50% match. This means that for every additional dollar you contribute after the first 6%, Walmart will contribute 50 cents.

This matching program allows Walmart employees to grow their 401(k) savings more quickly. For instance, if an employee contributes 6% of their salary and Walmart matches it dollar-for-dollar, the total contribution for that year could be as much as 12% of the employee’s salary. Over time, this can add up to substantial retirement savings.

Vesting Schedule for Matching Contributions in 401 k

While Walmart offers generous matching contributions, employees must meet certain requirements before they can take full ownership of these contributions. Walmart has a vesting schedule, which determines when employees are entitled to the company’s matching funds.

For Walmart’s 401(k) plan, the vesting schedule typically works as follows:

- Immediate Vesting: Employees are immediately vested in their own contributions (the money they contribute from their paycheck).

- Company Contributions: Walmart’s matching contributions become vested after three years of service with the company. If you leave the company before reaching this milestone, you will forfeit the company’s match, but you’ll still be able to keep the money you contributed.

This vesting period encourages employees to stay with the company longer to fully benefit from Walmart’s matching contributions.

Investment Options in Walmart’s 401(k) Plan

Walmart offers a wide range of investment options for employees’ 401(k) funds. These options typically include various mutual funds, target-date funds, bond funds, and stock funds. The investment options are designed to suit different risk tolerances and retirement goals.

Target-Date Funds Walmart 401k

One of the most popular choices among Walmart employees is the target-date fund. These funds are designed to automatically adjust the asset allocation as the employee approaches retirement age. For example, a target-date fund designed for retirement in 2050 will initially be more aggressive, with a higher proportion of stocks, but as the employee nears 2050, the fund will shift to more conservative investments, such as bonds, to reduce risk.

Index Funds

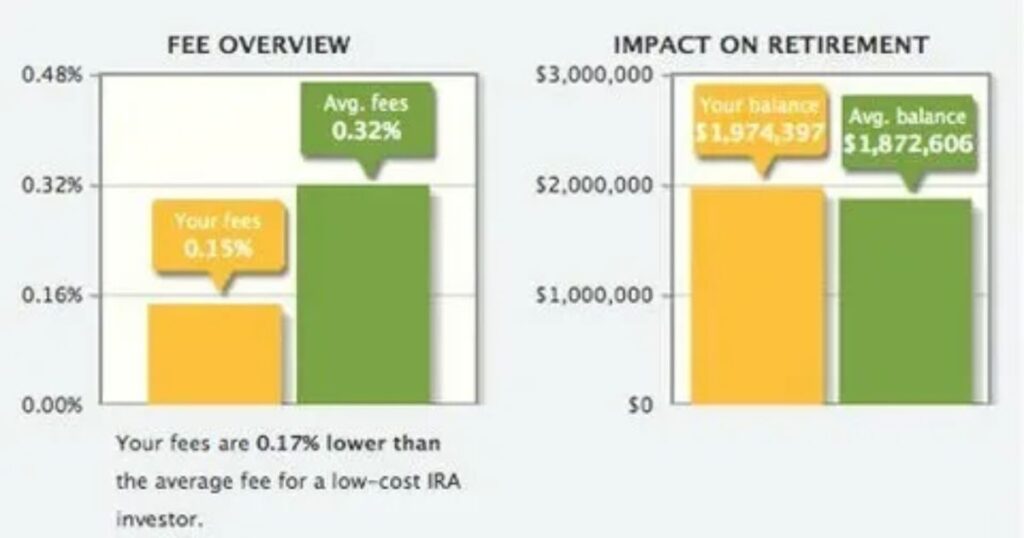

Walmart also offers a variety of low-cost index funds, which are a popular option for employees who prefer a more passive investment strategy. These funds track major stock market indices, such as the S&P 500, and typically have lower fees than actively managed funds.

Other Investment Choices

Walmart provides several other investment options, including bond funds, international funds, and more. Employees can mix and match these options based on their risk preferences, time horizon, and retirement goals.

How to Enroll in Walmart’s 401(k) Plan

Enrolling in Walmart’s 401(k) plan is a simple process, but employees must meet certain eligibility requirements before they can participate. Walmart’s 401(k) plan is available to both full-time and part-time employees, though part-time workers may need to meet certain thresholds to qualify.

Eligibility Requirements in Walmart 401k

To be eligible to participate in Walmart’s 401(k) plan, employees generally need to be at least 21 years old and have worked with the company for at least one year. This means that new hires typically need to complete a full year of employment before they can start contributing to the plan.

However, once an employee becomes eligible, they can start contributing to their 401(k) account as soon as they enroll. Employees can enroll online through the Walmart benefits portal or by contacting the company’s benefits team for assistance.

Enrollment Process Walmart 401k

Once eligible, employees will be invited to choose their contribution amount, investment options, and other plan details. It’s important to note that employees have the option to increase or decrease their contribution amount at any time. The 401(k) contributions are automatically deducted from an employee’s paycheck.

Additional Features and Benefits of Walmart’s 401(k) Plan

Walmart’s 401(k) plan offers several features that can benefit employees beyond the basic contribution and matching structure.

Financial Planning Tools

Walmart provides financial planning tools and resources to help employees make informed decisions about their retirement savings. These tools can help employees calculate how much they should save each month, estimate how their funds will grow over time, and choose the best investment options based on their goals.

Roth 401(k) Option

Walmart also offers a Roth 401(k) option, which allows employees to contribute after-tax income instead of pre-tax income. While Roth contributions are not tax-deductible, the funds grow tax-free, and withdrawals during retirement are also tax-free, provided certain conditions are met. The Roth 401(k) option is ideal for employees who expect to be in a higher tax bracket during retirement.

Rollovers and Portability

If an employee leaves Walmart and moves to another employer, they have the option to roll over their 401(k) funds into a new employer’s retirement plan or into an Individual Retirement Account (IRA). This ensures that employees don’t lose the value of their savings if they change jobs.

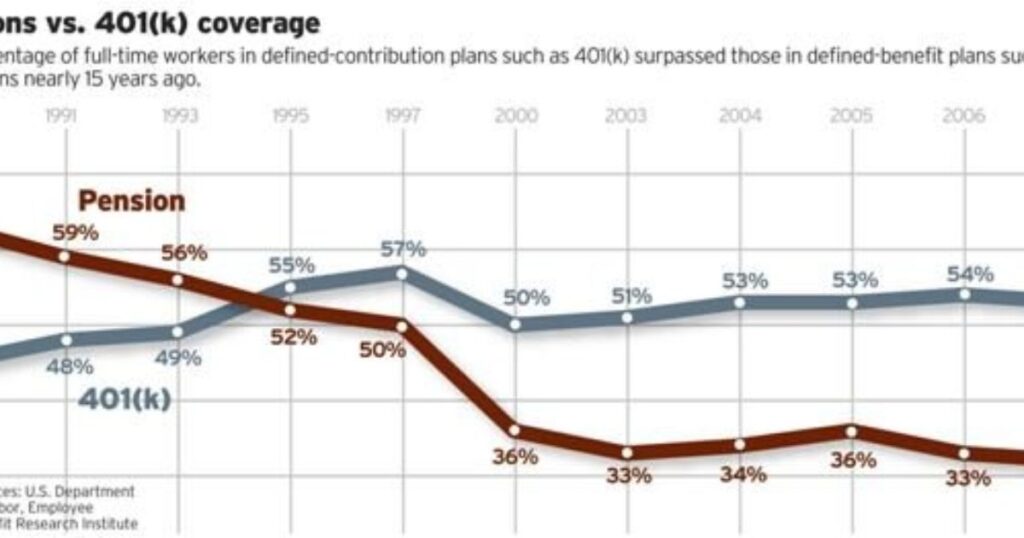

Comparing Walmart’s 401(k) to Other Employer Plans

When compared to other employers’ 401(k) plans, Walmart’s offering is relatively competitive. Many large companies offer matching contributions, but Walmart’s dollar-for-dollar match on the first 6% of contributions is generous. The vesting schedule is also relatively employee-friendly, allowing employees to vest in company contributions after just three years.

However, it’s worth noting that some companies may offer higher overall matching contributions or more investment options. Employees should always review the plan details when considering their retirement savings options to determine the best choice for future.

Suggestion’s

- Simplify the Explanation of Matching Contributions: Break down Walmart’s matching structure with examples, showing real-life scenarios of how much employees can potentially receive in matching funds based on their contributions.

- Highlight the Importance of Early Enrollment: Emphasize the benefits of enrolling in the 401(k) plan early in one’s career at Walmart to take full advantage of compound growth and employer contributions over time.

- Compare with Industry Standards: Provide comparisons between Walmart’s 401(k) plan and similar plans offered by competitors to give context and show how Walmart’s plan stacks up against other large employers.

- Discuss the Benefits of Roth 401(k): Delve deeper into the Roth 401(k) option and why it may be beneficial for employees, particularly younger employees who are early in their career and may benefit from tax-free withdrawals later on.

- Break Down the Vesting Schedule Clearly: Use simple language to explain the vesting schedule and why employees should be aware of it, especially how it impacts those who might leave the company before reaching full vesting.

- Highlight the Available Investment Options: Provide a detailed overview of the investment options in Walmart’s 401(k), such as mutual funds, index funds, and target-date funds, and explain the benefits of each.

- Address the Role of Financial Planning Tools: Elaborate on the financial planning tools Walmart provides to help employees make informed decisions about how much to contribute and how to allocate investments based on their retirement goals.

- Focus on Long-Term Benefits of the Plan: Emphasize the importance of consistency in contributions and long-term growth, showing how the Walmart 401(k) plan can be a powerful tool for future financial security if employees start contributing early and consistently.

- Incorporate Employee Testimonials or Stories: Add real stories or hypothetical scenarios of Walmart employees benefiting from the 401(k) plan to make the article more relatable and engaging.

- Provide Actionable Steps for New Employees: Offer a step-by-step guide for new Walmart employees on how to enroll in the 401(k) plan, including how to adjust contribution amounts, choose investment options, and access the plan online.

Conclusion

Walmart’s 401(k) plan is a valuable benefit for employees looking to save for retirement. With competitive matching contributions, a wide range of investment options, and helpful financial planning tools, Walmart offers a comprehensive retirement savings plan that can help employees build wealth over time. Whether you are just starting your career at Walmart or have been with the company for years, taking advantage of the 401(k) plan can be a smart move to secure a comfortable and financially stable retirement.

FAQ’s

What is Walmart’s 401(k) plan?

Walmart’s 401(k) plan is a retirement savings account that allows employees to contribute a portion of their paycheck for long-term savings. Employees can also receive matching contributions from Walmart to help grow their savings. The plan offers a variety of investment options to suit different retirement goals.

How does Walmart’s matching contribution work?

Walmart matches 100% of the first 6% of employee contributions, and 50% of any additional contributions made beyond that. This means employees can get a significant boost to their savings by contributing to their 401(k) plan. The matching contributions help employees build a larger retirement fund.

What is the vesting schedule for Walmart’s 401(k) matching contributions?

Employees are immediately vested in their own contributions but must work for Walmart for at least three years to fully vest in the company’s matching contributions. If employees leave the company before three years, they may forfeit Walmart’s match but keep their own contributions.

Can I choose how my Walmart 401(k) funds are invested?

Yes, Walmart offers a wide range of investment options, including mutual funds, index funds, bond funds, and target-date funds. Employees can choose their investments based on their risk tolerance and retirement goals, allowing for a personalized strategy.

How do I enroll in Walmart’s 401(k) plan?

Employees can enroll in Walmart’s 401(k) plan online through the company’s benefits portal once they meet eligibility requirements, which typically include being at least 21 years old and having worked for Walmart for at least a year. After enrollment, employees can start contributing and choose their investment options.